Why “In-Kind ETF Seeding” Matters More Than It Sounds

- Chandra Sekar Reddy

- Jan 4

- 3 min read

Even though I work closely in ETF technology, I’ve surprisingly never written about ETFs themselves. Most of my writing so far has focused on platforms, systems, and the engineering that supports technology products rather than the products they enable.

This blog is my first attempt at changing that.

It brings together what I’ve learned over time—through building, supporting, and operating ETF platforms—and translates it into a practical explanation for anyone who wants to better understand how ETFs actually work. My hope is that this perspective helps demystify some of the mechanics behind ETFs, especially for those curious about what happens behind the scenes.

A Quiet Headline with a Big Meaning

Recently, the ETF industry noted:

“ETFs seeding in-kind raised ~$3 billion in 2025.”

At first glance, this sounds like just another industry statistic. But beneath it lies a meaningful shift in how ETFs are launched, how institutions participate, and why ETFs have become one of the most efficient investment vehicles in modern markets.

Let’s unpack what this really means—and why it matters.

What Does “In-kind Seeding” Mean?

Every ETF needs an initial pool of assets before it can begin trading. This is known as seeding—essentially giving the fund enough scale to operate, trade efficiently, and attract investors.

Traditionally, ETFs were seeded with cash. Increasingly today, they are seeded in-kind.

In-kind seeding means:

Institutions contribute actual securities (stocks or bonds)

Instead of contributing cash

In exchange for newly created ETF shares

This structural detail may seem minor, but it has outsized implications.

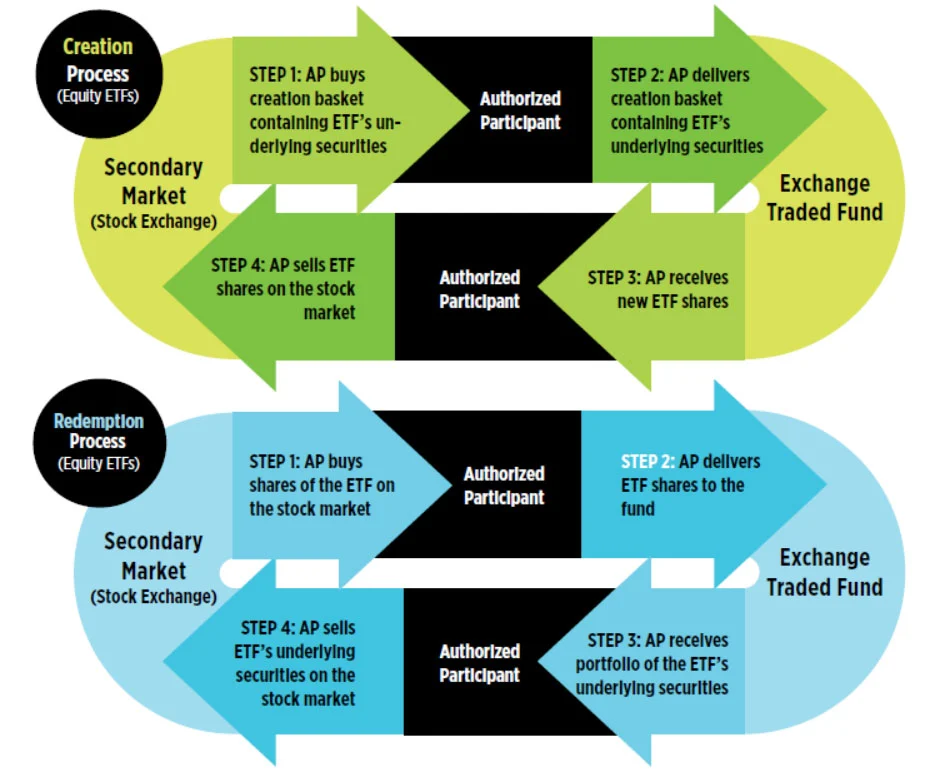

The Traditional ETF Launch: Cash First, Costs Later

In a traditional, cash-seeded ETF launch:

An investor provides cash

The ETF sponsor must buy securities in the open market

Trades incur transaction costs and bid-ask spreads

Large trades can move prices

Early tracking error is common

Taxable events may be triggered

This model works—but it’s operationally and tax inefficient, especially at scale.

The Modern ETF Launch: In-Kind From Day One

With in-kind seeding, the process is cleaner:

An institutional investor delivers a basket of securities

The basket mirrors the ETF’s intended holdings

The ETF issues shares in return

No securities are bought or sold

No cash changes hands

No immediate tax event occurs

The ETF launches fully invested, accurately tracked, and liquid from day one.

Why Institutions Prefer In-Kind Seeding

There are four primary reasons institutions overwhelmingly favor in-kind seeding:

1. Tax Efficiency

Because securities aren’t sold, no capital gains are realized. This preserves one of the ETF structure’s biggest advantages right from launch.

2. Lower Transaction Costs

Avoiding market purchases eliminates:

Brokerage fees

Bid-ask spread losses

Market impact from large trades

3. Better Liquidity

ETFs launched in-kind typically exhibit:

Tighter bid-ask spreads

Deeper liquidity

Stronger market-maker support

4. Operational Precision

The fund starts life already holding the right assets in the right proportions, minimizing early tracking error.

Why “in-Kind Seeding” Is a Meaningful Signal

That ~$3 billion figure isn’t retail money testing the waters. It represents institutional balance-sheet capital committing at launch.

It signals:

Strong institutional confidence in ETF innovation

Growing comfort with active and thematic ETFs

A clear preference for tax-optimized structures

Continued evolution away from legacy fund-launch models

In short, ETFs today are not just investment wrappers—they are carefully engineered financial products.

The Bigger Picture: ETFs Are Built, Not Just Sold

The rise of in-kind seeding reflects a broader reality in modern markets:

The best financial products are engineered for efficiency long before the first investor clicks “Buy.”

ETF design now prioritizes:

Tax outcomes

Liquidity mechanics

Market impact

Long-term scalability

In-kind seeding isn’t a niche feature—it’s a design philosophy.

A Simple Analogy

Think of launching a restaurant:

Traditional launch:

“Give me cash—I’ll go buy the ingredients.”

In-kind launch:

“Bring the ingredients—you get ownership.”

Same destination. Very different efficiency.

Final Thought

The next time you see a headline about ETF seeding, remember:

It’s not about how much money came in.

It’s about how intelligently the system is built.

And $3 billion of in-kind seeding tells us the smartest players are paying close attention.

As someone working in ETF technology, writing this blog felt like closing a loop—connecting the systems I work on every day with the products they support.

If this helps even a few readers better understand how ETFs are built—not just how they trade—then it’s a good first step.

And hopefully, not the last blog on ETFs.

Comments